News Blog

Keep up to date with the latest news, insights and features from the Adelphi Group of Companies

Adelphi Masterfil breaks down the benefits of the new Super-Deduction Capital Allowance

May 7, 2021

Super-Deduction Capital Allowance: Improve your productivity and increase your ROI, from 1st April 2021

In the latest budget, a new incentive was announced to stimulate greater cost- and operational-efficiency in R&D and manufacturing. The ‘Super-Deduction’ scheme effectively reduces the purchase price of your new equipment (through additional corporation tax relief), meaning that there has never been a better time to expand your department’s capabilities. Find out more >>>

The UK Super-Deduction Capital Allowance is a temporary tax incentive introduced by the UK government to encourage business investment in qualifying plant and machinery assets. Announced in the 2021 Budget, the super-deduction allows companies to deduct 130% of the cost of qualifying investments from their taxable profits. This deduction is more generous than the standard capital allowances, which typically allow for deductions of 18% or 6% on a reducing balance basis. The super-deduction applies to qualifying expenditures made between April 1, 2021, and March 31, 2023. Eligible assets include new, unused plant and machinery that would ordinarily qualify for the main rate of capital allowances. The super-deduction is designed to stimulate economic recovery by incentivizing businesses to invest in assets that enhance productivity and innovation. It provides a significant tax relief opportunity for companies looking to make substantial capital investments during the specified period.

From artisan to multi-national businesses, this scheme makes investing in new equipment more cost-effective than ever before:

- A company making a profit will be able to reduce their corporation tax bill considerably more than previous years, if they invest in new plant and machinery.

+ - The initiative allows companies to cut their tax bill by up to 25p for every pound they invest.

= - Effectively, the cost of equipment purchase is being reduced by the extra tax relief.

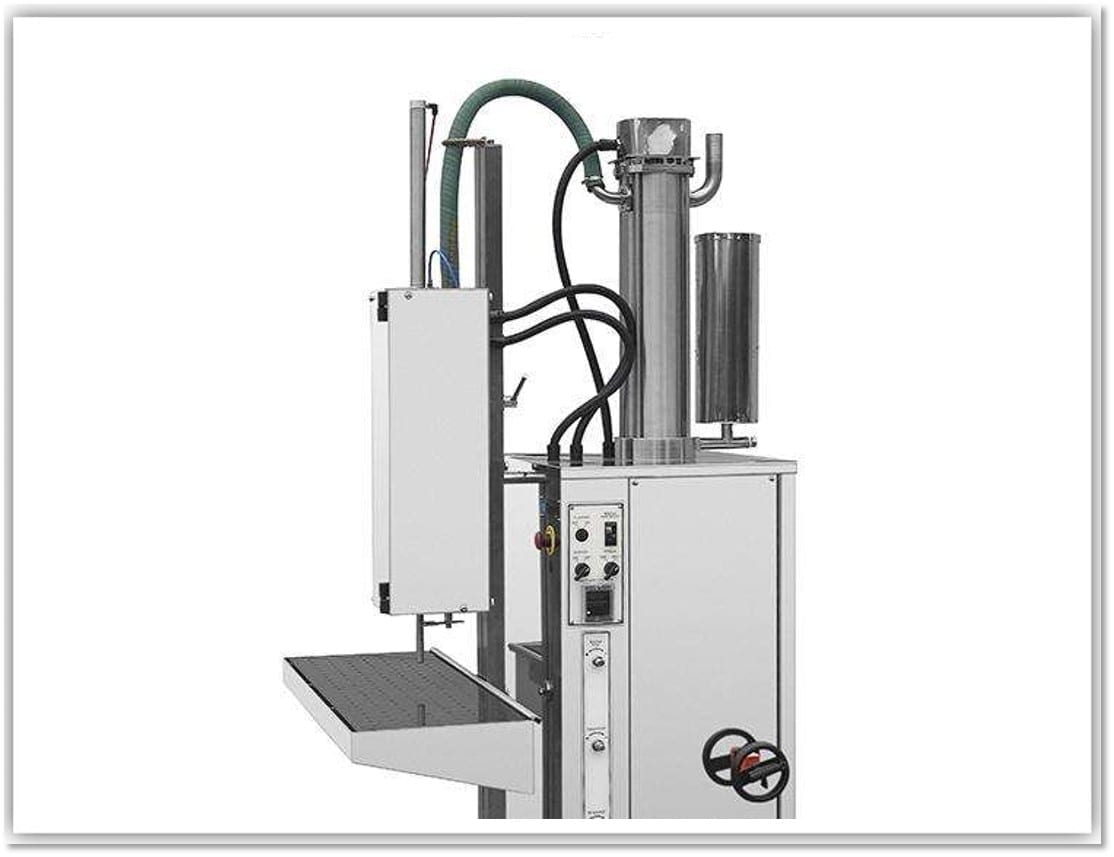

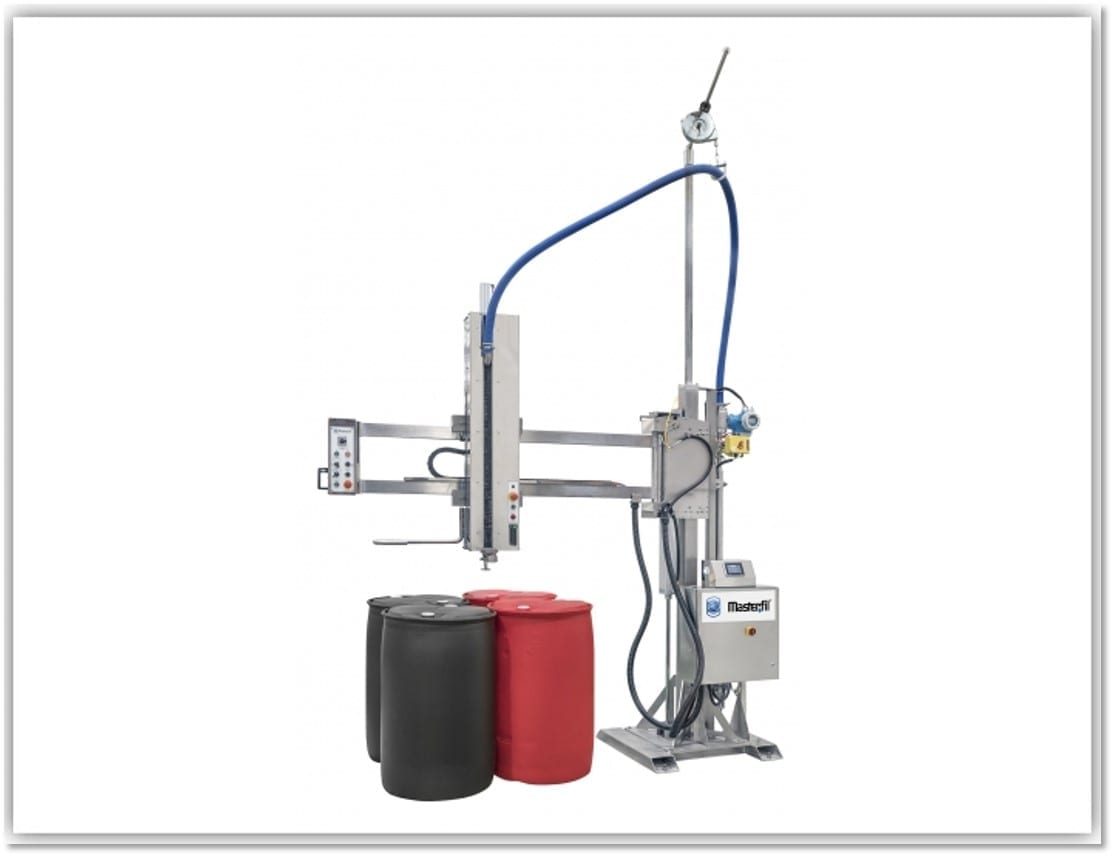

Super-Deduction Capital Allowance: Download our brochure of eligible solutions: Adelphi Masterfil >>>

Or browse by application:

Automatic Filling Semi-Automatic Filling Drum & IBC Filling